We’ve all heard the the spiel, “The best time to start investing is today”, “You need need to start investing when you’re young”, “Compounding is a powerful force”, or “Let your money work for you”. But what does this all mean? What is so powerful about compounding interest?

For anyone interested in personal finance, I think that one of the most important and core concepts you need to understand when managing money is how compounding interest works. With compounding interest working in your favor, you can earn higher and higher returns on your investments and savings. However, on the flip side, if you currently have any outstanding loans or debt, compounding interest can work against you. That’s why it’s essential to understand the impacts it has.

WHAT IS INTEREST?

First, how does interest work? Let’s say you want to start building your emergency fund, so you open a savings account at a bank and deposit some money. The bank will pay you for leaving your money with them, and this money is called interest. Why does the bank pay you? Because it wants to use your money to lend to other people or businesses. The bank makes money by charging higher interest rates on the money it lends out than the interest it pays to you.

SIMPLE INTEREST VS COMPOUND INTEREST

There are two basic types of choices when it comes to calculating interest: simple interest and compound interest.

Before we cover compound interest, let’s first start with the concept of simple interest. With simple interest, the interest is calculated based on the original deposit amount only. The interest amount earned is the same each payment period (i.e. annually). For example, if you put $1,000 in a bank that offers 5% simple interest per year, after 3 years, this is what you’ll receive (assuming you do not deposit any more money during that time):

| Year | Interest Calculation | Interest Earned | Your Money |

|---|---|---|---|

| Year 1 | $1,000 x 5% | $50 | $1,050 |

| Year 2 | $1,000 x 5% | $50 | $1,100 |

| Year 3 | $1,000 x 5% | $50 | $1,150 |

| Total | $150 |

While getting a whopping $150 over the course of 3 years is nice (not really, but better than nothing), compounding interest will earn you more.

With compound interest, your interest is calculated off the original deposit PLUS the interest earned on the deposit (aka interest on interest). The interest is calculated at the end of every compounding period and added to the account. This results in a larger ending balance that the next compounding period is based off of (even if you do not add additional money to your original deposit).

Using the example above, if you put $1,000 in a bank that offers 5% compounding interest per year, after 3 years, this is what you’ll receive (assuming you do not deposit any more money during that time):

| Year | Interest Calculation | Interest Earned | Your Money |

|---|---|---|---|

| Year 1 | $1,000 x 5% | $50 | $1,050 |

| Year 2 | $1,050 x 5% | $53 | $1,103 |

| Year 3 | $1,103 x 5% | $55 | $1,158 |

| Total | $158 |

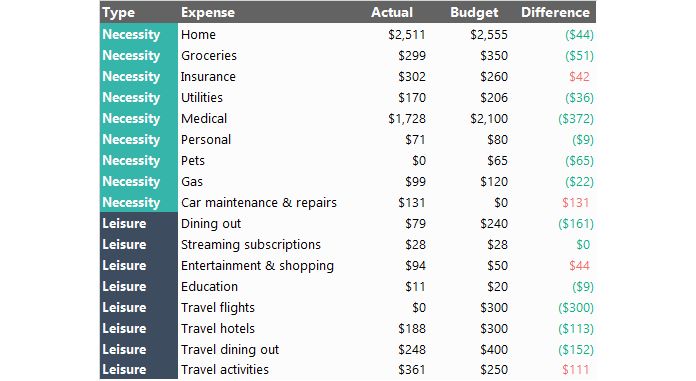

The amount of interest earned may not look so impressive in the first 3 years, but what happens after 50 years? This is how much money you will have at the end of 50 years depending on how your interest is calculated. Again, this is if you only made one $1,000 deposit.

If that’s not good enough for you yet, imagine if you decided to deposit an additional $1,000 at the beginning of each year for 50 years. After 50 years, you will have $219,269. Remember, by depositing $1,000 each year for 50 years, you only invested $50,000 — and earned $169,269 in interest payments.

KEY FACTORS OF COMPOUNDING INTEREST

The main factors that drive the performance of compounding interest include:

Time: The growth of your investments is larger with compounding over longer periods (because there are more interest calculations if you leave the money alone to grow)

Interest rate: The higher rate means the investment will grow faster

Compounding frequency: The more frequent the compounding periods, the larger the results. The examples above use compounding periods done annually. But some investment options compound interest monthly or daily (which are even better).

KEEP COMPOUNDING INTEREST WORKING ON YOUR SIDE

Pay down your debts quickly: Just like how a bank would pay you interest on top of your interest in a savings account, debt interest is calculated similarly but in this case, you are the payer. Most credit cards have double-digit interest rates, so if you do not pay off your credit card payments in full, you could end up paying more money than you had originally charged to the card. Not cool. Pay your debts down quickly, and pay extra when you can.

Borrow at low rates: The interest rate on your loans determines how quickly your debt balance will grow. This will impact your monthly payments, as well as the time it will take you to pay it off.

Start saving early: Time is your best friend when it comes to growing your savings. The longer you leave your money alone to grow, the larger returns you will receive. The more often you can make deposits into your savings as well, the greater the impact as well.