Up until last year, I was embarrassingly naive when it came to personal finance and money management. And when I say embarrassing, I mean I had been working in finance for 5 years and spent more time in Excel than with my friends. Yet when it came to my income and expenses, I just couldn’t get a good grasp of it.

I STARTED SAVING

A few years ago, I started to cut my spending. My savings started to build up in my Chase savings account, and I was happy to see it grow. So happy that I couldn’t fathom the idea of moving it out of Chase. I felt the need to hoard it all in one place, and I feared that if I moved any of it out, I would lose the liquidity or safety of those funds.

How much should I save as my emergency fund? Should I invest some of it? If so, how much in stocks or bonds? Which ones should I be picking and how much money should I invest? But what if the market tanks, and I need my money next year? So many options, too many directions - I had analysis paralysis. And so there it all sat … quietly parked at Chase bank.

This went on for years. Years. I just left that money in my Chase bank savings account sitting there for years.

TRADITIONAL BANKS DON'T PAY SQUAT

As you probably know, banks pay you an interest (also known as ‘yield’) for leaving your cash with them (see how interest works here). But they pay very little. For example, if you leave your cash in a Chase savings account, Chase will pay you 0.01% in interest each year. I mean, what even is that 😐.

This means that if you deposited $1,000 today, a year later you’d earn enough to pay for ONE Trader Joe’s grocery paper bag. Yes, you heard me right - you will earn a whoppin $0.10. Better skip out on those chocolate peanut butter cups, lest you should need an extra bag.

WHAT IS A HIGH YIELD SAVINGS ACCOUNT?

There are a few places you could move your money into, but today I’ll cover high yield savings accounts since I just recently opened my own. High yield (or interest) savings accounts are bank accounts that earn you higher interest than a traditional savings account does. Compared to the traditional 0.01%, you could be looking at 1.6% to 2.0% instead.

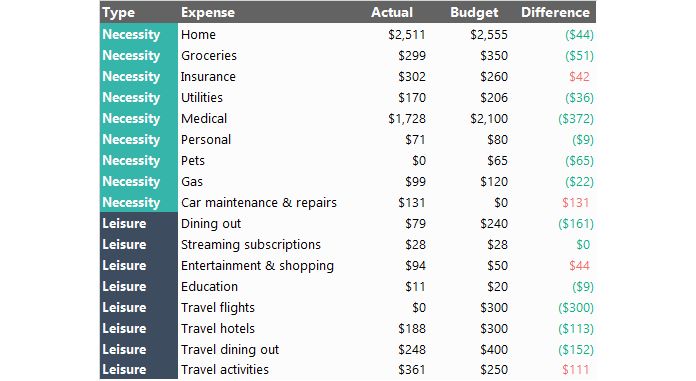

Going back to the example above, if you deposited $1,000 today, here’s the difference of what you could look to earn in interest. The difference would be even larger if more money was deposited.

| Type of Savings Account | Interest Rate | Interest Earned | Balance After 1 Year |

|---|---|---|---|

| High yield savings account | 2.00% | $20.00 | $1,020.00 |

| Traditional savings account | 0.01% | $0.10 | $1,000.10 |

Are high yield savings accounts safe? Yes. As long as you pick a bank that is FDIC-insured (most of them are), just like your traditional savings accounts (i.e. Chase, Bank of America, Wells Fargo), high yield savings accounts are federally insured for up to $250,000. This means the government will protect up to $250,000 of your deposits in case the bank fails.

Is money deposited in high yield savings accounts easily accessible? Yes. You can easily transfer your cash back and forth between your traditional bank and an online high yield savings account. Keep in mind, the government limits you to 6 monthly savings transfers / withdrawals. This applies to all traditional banks, so does as well with high yield savings accounts. Additionally, depending on the bank, just leave room for a few days to process the money transfer.

So what’s the catch? There is none. You’re literally just getting more money without extra effort (aside from moving the money there).

For a list of online savings accounts in your area, you can check out Bankrate. I’ve listed a few here below, in no particular order:

Marcus by Goldman Sachs (this is the one that I personally use, and it’s been great so far)

Ally (I plan to use this in the near future)

LEARN FROM MY MISTAKES

The years that I left my money in my Chase savings account were just wasted opportunities to have my money work for me. I can’t give you a rational explanation for why it took me this long to become more proactive on earning this truly passive income.

I think it’s due to lack of awareness / exposure to these alternative accounts where I could move my cash to, that continued to give me the liquidity I was looking for.

MY PLANS WITH PARKING MY CASH

For now, I’d like to keep my cash liquid, because I might purchase real estate in the next year or so. But leaving it in my low interest savings account is just a waste. So I’m currently in process of moving most of my emergency funds and excess cash into online high yield savings accounts (and a few other investment options, which I will talk more about later).