The Federal Reserve impacts the lives of US citizens every day. It’s considered the most important and powerful financial institution of the United States.

Particularly in response to recent times, the Federal Reserve has made the news for “cutting rates”, “buying billions worth of government bonds” and being tied to the rising trend of money printing memes.

These news impact your life (well maybe not the memes), so it’s always good to have a basic knowledge of what the Federal Reserve does and how it affects your wallet.

Although this post will focus on the effects of the Federal Reserve, a brief description of what it is is helpful.

WHAT IS THE FEDERAL RESERVE?

The Federal Reserve System (aka the Federal Reserve or simply the Fed) is the central bank system of the United States.

⚠️ Don't be confused! The Federal Reserve is not a single, central bank building sitting somewhere in the US

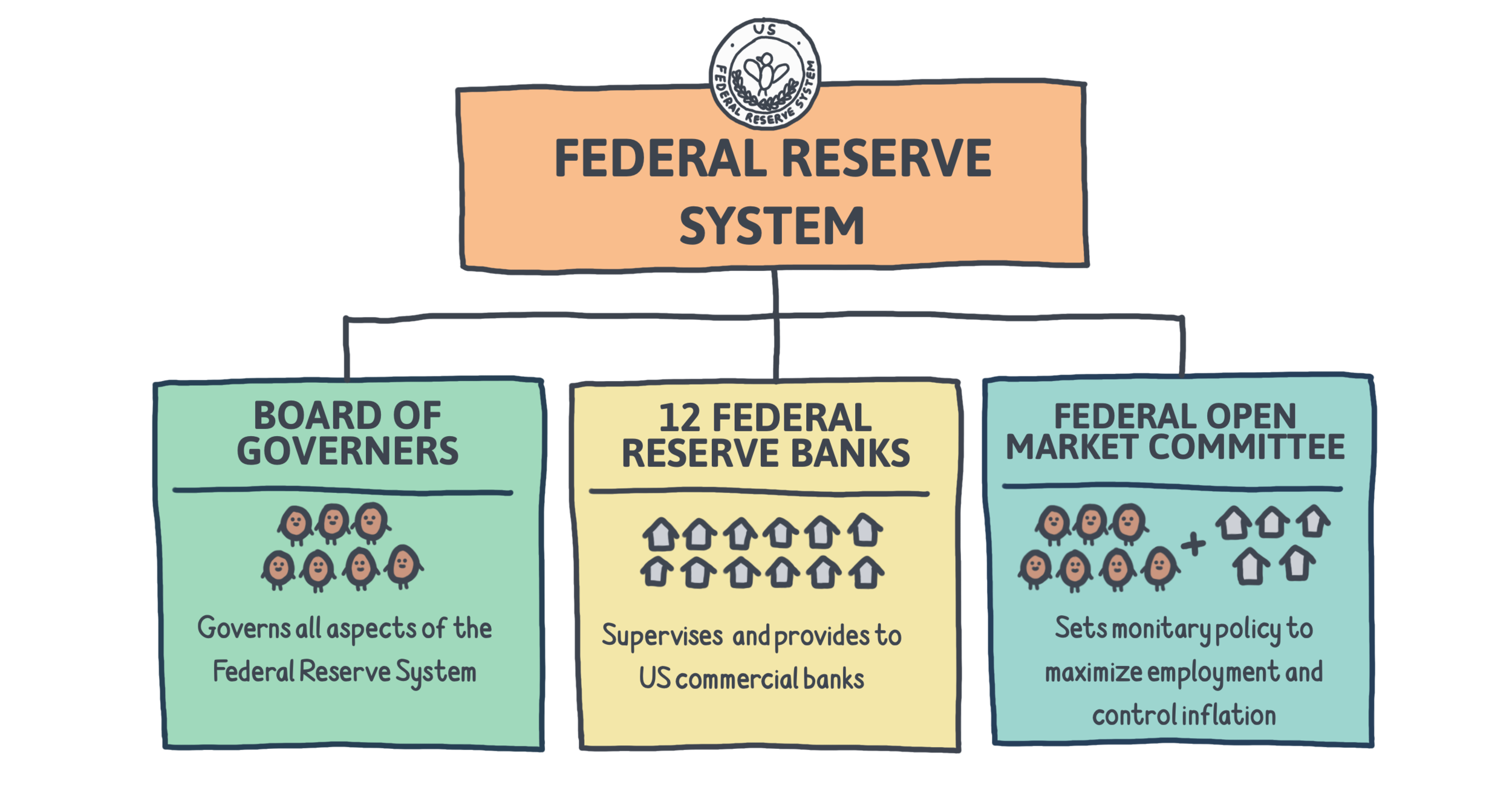

The Federal Reserve is comprised of 3 components:

1. Board of Governors (7 people)

Role: Governs all aspects of the Federal Reserve System

2. 12 Federal Reserve Banks (sprinkled throughout the US, each with its own president)

Role: Supervises the US commercial banks

3. Federal Open Market Committee (FOMC) (Board of Governors + 5 Federal Reserve Bank presidents)

Role: Manages the nation’s money supply

WHAT IS THE PURPOSE OF THE FEDERAL RESERVE?

While the Federal Reserve has numerous functions, its two most critical and publicly visible are to:

1. Reduce unemployment

2. Control inflation

The Fed manages its goals by using monetary policy. Monetary policy is the Fed’s actions to increase or decrease the US’s money supply. By regulating the money supply, the Fed can help manage the economy’s unemployment and inflation levels. The Fed needs to delicately balance the money supply at all times. Why?

By increasing money supply - the Fed can drive economic growth, but this can result in inflation (rising prices for goods and services)

By decreasing money supply - the Fed can slow inflation, but this can lead to deflation and slow economic growth

HOW THE FED CONTROLS THE MONEY SUPPLY

The three main tools that the Fed uses to manage the amount of money in circulation are:

1. The Fed will add or deduct cash from the US banks (by buying or selling bonds from the US banks)

If the Fed wants to add more money into the US, it will buy bonds from US banks in exchange for cash. Simply put, the Fed is essentially creating cash out of thin air and injecting that cash into the banks. This cash creation is what people are referring to when they say the Fed is “printing money”. With excess cash, the banks will lend out more money to increase their profits and will reduce their lending rates.

☝️ When you hear about the Fed printing money 🖨️, it's not actually printing physical dollar bills. It is actually creating cash (electronically) out of thin air and adding that cash to US banks. Imagine something similar to a direct deposit into your checking account.

The opposite happens when the Fed wants to pull money out of the US. The Fed will sell bonds to the US banks. The US banks must pay the Fed for these bonds. This reduces the US banks’ cash balances. As cash becomes tight, banks will reduce lending and interest rates will increase.

2. The Fed sets the reserve requirement (the amount of cash each US bank is required to have on-hand each night)

The rest of the money can be lent out to consumers and businesses. By setting a higher reserve requirement means that banks have less money to lend out, and are less likely to lend as much money to consumers and businesses. On the flip side, a lower reserve requirement allows banks to lend out more money.

💡 The more you know! The Fed lowered the reserve requirement to 0% on March 26, 2020 in response to the Coronavirus pandemic. It was previously 10%.

3. The Fed sets the Federal Funds Rate (the interest rate that US banks charge other US banks to borrow cash)

If a US bank doesn’t have enough cash on hand at the end of the day to meet the reserve requirement, it will borrow from other US banks overnight to meet the requirement. The US banks that have more money than they need will lend the excess cash to the banks who don’t have enough, charging the Federal Funds Rate.

When the Fed lowers the Federal Funds Rate, it allows US banks to pay less interest for borrowed funds. By paying less interest, they have more money to lend. As a result, US banks can lower the interest rates they charge consumers and businesses.

💡 The more you know! The Fed lowered the Federal Funds Rate to a range of 0% - 0.25% on March 15, 2020 in response to the Coronavirus pandemic. Knowing the current rate is important because this rate influences the benchmark that lenders look to when they decide what interest rates to charge.

HOW THE FED AFFECTS YOU (DIRECTLY)

Now that we have a better understanding of how the Fed can impact the overall economy, the below discusses how some of the changes can affect your daily life (particularly your money).

Savings account rates and CD rates are tied to the Federal Funds Rate. This is one situation where a higher Federal Funds Rate (and thus interest rate) can be a good thing, especially if you have a lot of cash sitting in your savings account (maybe if you are saving up for a large purchase or vacation). You may have noticed these few months that your savings account and CD account rates have been plummeting. This is because the Fed reduced the Federal Funds Rate down to 0% - 0.25%.

Credit card interest rates are tied to the Federal Funds Rate. A higher Federal Funds Rate results in a higher interest rate charged to credit card holders with variable interest rates. Ideally, this wouldn’t impact you, as you should always pay off your credit card balances at the end of each month.

Auto loan interest rates are tied to the Federal Funds Rate. Same as the credit cards, auto loan interest rates generally move in-line with the Federal Funds Rate. Keep in mind that your credit score and the lender’s confidence in your ability to pay off the auto loan plays a role in determining your interest rate as well.

Mortgage rates are tied to the Federal Funds Rate (sort of). Mortgage rates primarily follows the bond market. When the Federal Funds Rate drops, most people assume that the mortgage rates will fall right away. But they tend to have a delayed impact on mortgage rates. Keep in mind that your credit score, your down payment, supply and demand and other factors may influence your mortgage rate as well.

HOW THE FED AFFECTS YOU (INDIRECTLY)

1. Employment

The Fed’s ability to increase or decrease money supply and interest rates can drive businesses’ lending activity. If borrowing costs for businesses become more affordable, companies are more likely to borrow to invest into the business and expand. This results in hiring more employees, whose incomes will rise.

If interest rates rise, the cost of loans will become more expensive. As a result, it becomes less attractive for companies to go into expensive debt in order to expand its business. This results in fewer employment opportunities.

2. Inflation

The Fed can increase money supply to spur economic growth, since it lowers interest rates and increases spending. However, if the economy is growing too quickly, businesses can increase prices on goods and services, which will lead to inflation. Moderate inflation is good, since people expect prices to rise, so they will purchase goods now to avoid future price increases. This demand is needed for a healthy economy. However, if inflation levels rise too high and quickly, it means your hard-earned money isn’t worth as much any more.

On the flip side, the Fed can decrease money supply and increase interest rates to avoid inflation levels getting too high. Higher interest rates make borrowing more expensive. As a result, people are less likely to buy autos, homes or take out loans. People will also hold onto their money, and businesses may have to drop prices of goods and services. If the trend continues, consumers may continue to postpone spending as they anticipate prices will continue to drop in the future, which can push the economy into a recession. The balance between the two is key.

APPLY YOUR KNOWLEDGE

The Federal Reserve has appeared in the news recently for its response to the Coronavirus pandemic to limit the economic damage. Now that you have a better understanding of the Federal Reserve’s role in the US economy, take a look at a recent article from The New York Times to see some of the things the Fed is currently doing: Fed Slashes Rates to Near-Zero and Unveils Sweeping Program to Aid Economy (March 15, 2020)